tax avoidance vs tax evasion nz

The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax expenses and avoidance is the highly. Tax evasion and tax avoidance are often used interchangeably.

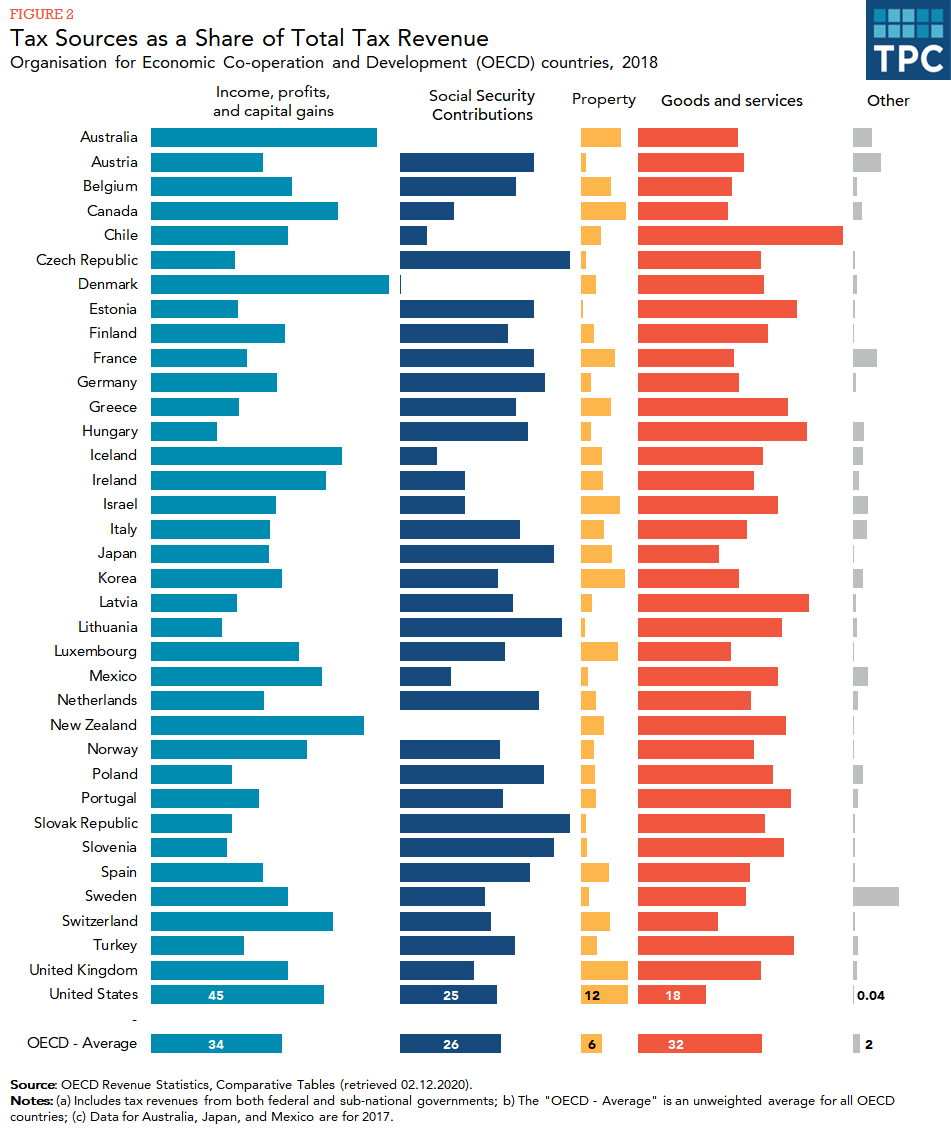

Consumption Tax Policies Consumption Taxes Tax Foundation

Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed.

. You might do this by claiming tax credits for example or. The Govt is trying. The following are the examples of tax evasion.

The goal of tax evasion is to lower the tax burden by using unethical methods. Key Differences between Tax Evasion vs Tax Avoidance. Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4.

Tax avoidance vs tax evasion nz Thursday March 31 2022 Edit. Its because theres a difference between tax avoidance and tax evasion. To start with tax.

In tax planning a taxpayer is doing what the govt wants him to do whereas in tax. Tax avoidances repercussions tax burden is postponed. Tax avoidance and tax evasion are different methods people use to lower taxes.

However there is a huge difference between the two terms. In tax avoidance you structure your affairs. Tax evasion is a.

10 Blacks Law Dictionary 9th ed 2009 Tax Evasion at 1599. Tax Evasion vs. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business.

Tax mitigation is not a term of art14 and recently the New Zealand Supreme Court has said the mitigationavoidance. Making a false statement in a return. People who cheat the tax system are tax criminals.

In Tax Planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance a taxpayer is doing something which the govt didnt expect the taxpayer to do. It is a legal. Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed.

How we deal with tax crime Were committed to. 8 John Prebble and Zoe Prebble The Morality of Tax Avoidance 2010 20 Creighton L Rev 101 at 112. The goal of tax avoidance is to lower ones tax.

Tax evasion is when you use illegal practices to avoid paying tax. This is generally accomplished by claiming. The difference between tax avoidance and tax evasion boils down to the element of concealing.

This could include not reporting all of your income not filing a tax return hiding taxable assets from. What tax crime is Everyone pays tax on their income to help fund public services. Making a false return of income by omitting or understating income or overstating expenses.

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Without More Enforcement Tax Evasion Will Spread Like A Virus The New York Times

Tax Evasion A Matter Of Culture Jobs Ca

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Lobster T Shirt For Sale By Bilbo406 Redbubble Taxes T Shirts Tax T Shirts Tax Fraud T Shirts

Tax Fraud Vs Tax Evasion Vs Tax Avoidance

Avoidance Evasion Or Avoision Interest Co Nz

No Corporate Tax Avoidance Is Not Legal Financial Times

Tax Morale And International Tax Evasion Sciencedirect

Cybersecurity Basics For The Tax Practice Tax Pro Center Intuit

The Impact Of Corporate Governance On Corporate Tax Avoidance A Literature Review Sciencedirect

How Do Us Taxes Compare Internationally Tax Policy Center

Chris Schraders Chrispy Twitch Twitter

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences